To maintain a trade or rollover the trade from one day to the next, the trade is subject to a swap. Find out what swap points are and how they work in this article.

- Rollovers on financial instruments occur overnight on the underlying instrument.

- They affect traders by accruing or charging open positions with either positive or negative swap points, depending on the instrument.

To maintain a trade or rollover the trade from one day to the next, the trade is subject to a swap. This is otherwise known as the amount of interest charged or credited to your account to maintain the trade and differs across instruments.

In order to have a clear picture about how a trader’s position may be affected by holding the position overnight, it is important to understand how many pips will be accrued or charged on the trader’s position.

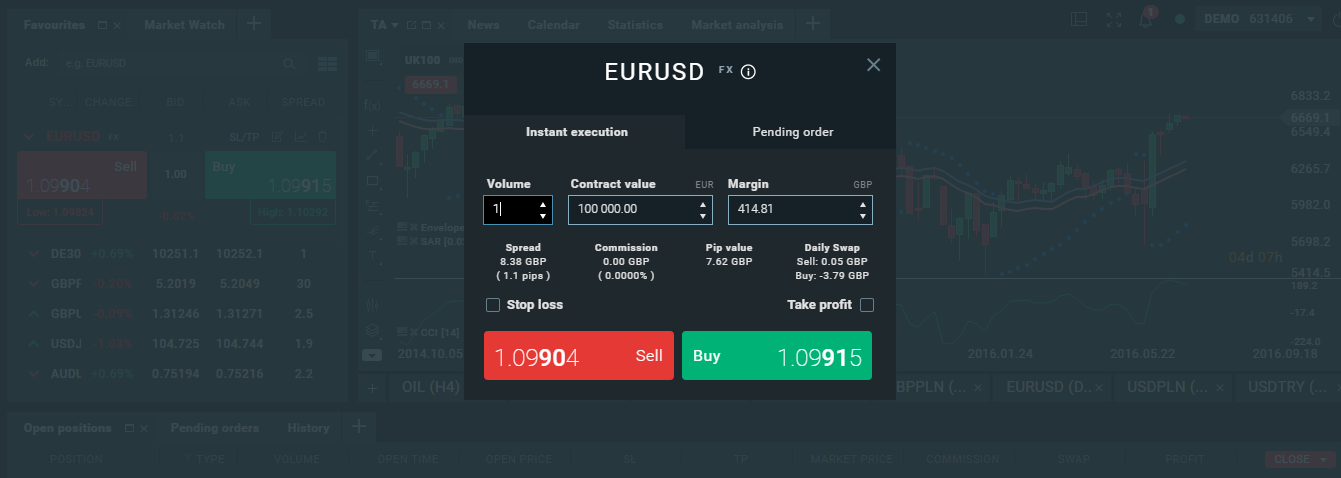

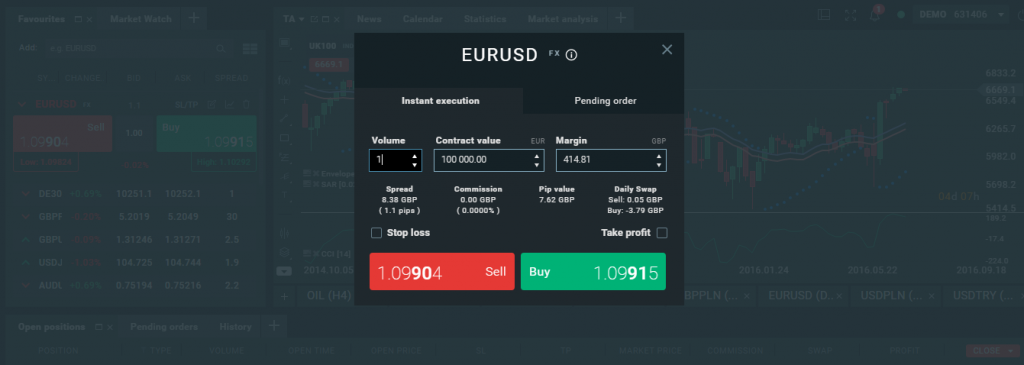

Swap points may be calculated manually after calculating the value of a pip, but one of the xStation’s unique functionalities is the inbuilt calculator, which helps traders with many automatic calculations depending on the market the trader would like to trade on as well as the volume.

Source: xStation

As seen in the screen above, in case a trader opens a 1 lot transaction on the EURUSD, then if the trader holds a Sell transaction overnight their account would be accrued with the value of 0.05 GBP. On the other hand if the trader holds a Buy transaction overnight their account would be charged with the value of 3.79 GBP.

The accruals and the charges are dependant on the financial instrument the trader is interested in, and many traders have strategies based on holding positions overnight in order to receive the highest possible accruals. Popular markets used for such strategies include USDTRY, USDMXN and EURAUD.

Additionally, most indices do not cause any accruals or charges to the trader’s open positions. You can find the complete swap point rates here.

The swap point rates may help traders who do not use the xStation’s inbuilt trader’s calculator to manually calculate the swap points that may affect open positions. This can be done with the following calculation:

Swap point rate x Pip value